How to claim pre-trading expenses from your limited company?

It is quite common for business owners to personally accrue pre-trading business expenses prior to when their company was formed. You will normally incur these costs while operating as a sole trader.

For example, if you’ve purchased a work laptop a few years back or stationary equipment for your new office.

Claiming expenses as a Sole Trader or via your Limited Company

If you’re operating as a sole trader, these business expenses can be declared and reclaimed on your annual Self-Assessment tax return.

When it comes to claiming pre-trading company expenses, these can be declared on the company’s Corporation Tax return, up to 7 years before the company was formed.

Claiming VAT

If your business is VAT registered, you can also claim back VAT on pre-trading expenses, for up to 4 years before your company was formed.

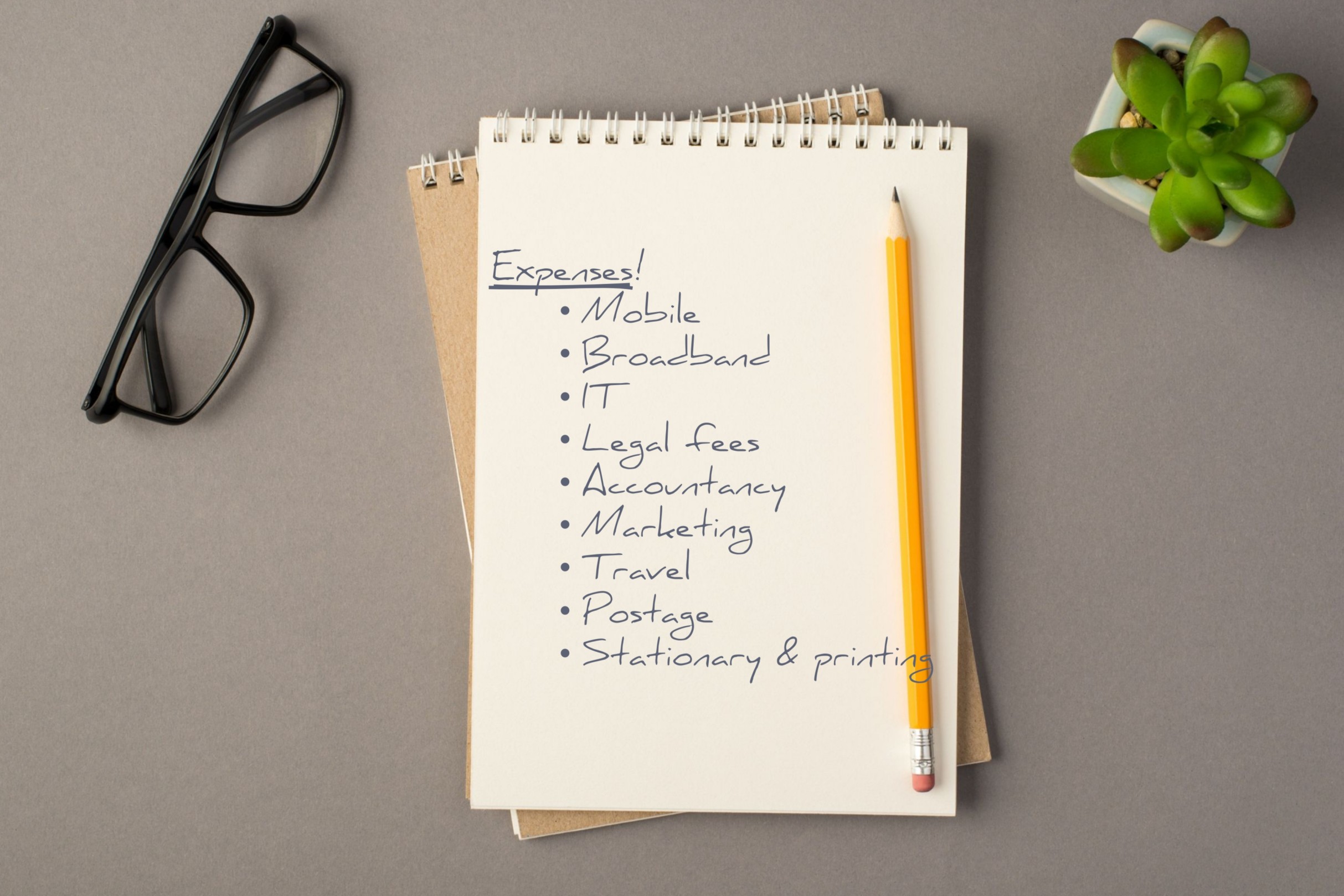

Here are some of the allowable pre-trading expenses you can claim back.

- Office costs – stationery or phone bills

- Travel costs – fuel, parking, train or bus fares

- Clothing expenses – uniforms

- Staff costs – salaries or subcontractor costs

- Things you buy to sell on – stock or raw materials

- Financial costs – insurance or bank charges

- Costs of your business premises – heating, lighting, business rates

- Advertising & marketing – website costs

- Training courses related to your business, for example, refresher courses

Can you reclaim costs related to forming your company?

Unfortunately, costs directly involved with incorporating a company such as the filing fee paid to Companies House will be considered a one-off capital cost rather than pre-trading expenses.

Hence, you wouldn’t be able to declare these costs on your first Corporation Tax return.

Further things to bear in mind when claiming pre-trading expenses

- Make sure you keep accurate records of purchases made, including receipts.

- You can only claim for expenses that are solely for the benefit of the business. Under the ‘Duality of Purpose‘ rules, you cannot claim for costs that have a personal benefit.

- You must not make any purchases using a proposed company name until it has been formed at Companies House.

- Always speak to your accountant if you have any questions relating to company expenses.

Limited companies

A guide to using your company

Tide bank account

All new applications for a Tide bank account will earn £100 cashback – find out more about Tide

Our packages

Digital - £11.95

Cost-effective, simple solution for those who do not wish to start trading just yet, or would like to register their new limited company as dormant.

Privacy - £19.95

Ensures your address will not be made public at Companies House. Protect your privacy with a registered office address or director’s home address.

Professional - £44.95

The perfect company formation solution that takes care of the heavy lifting of setting up your new limited company, with Companies House and HMRC.

All-Inclusive - £94.95

The perfect company formation solution that takes care of the heavy lifting of setting up your new limited company, with Companies House and HMRC.